Asset Classes Meeting Our Investment Criteria

OFFICE

- Office deals that fit our criteria can typically be found in Class B or C suburban properties.

- Class A or CBD properties can be reached in secondary/tertiary markets (Columbia, Greenville, Fayetteville, Charleston).

- Office properties of any class and location that are underappreciated with high vacancy and operational upside can be acquired at discounted prices that allow us to enter markets and classes that are typically out of reach.

RETAIL

- Retail deals that fit our criteria can be found in Class B or C neighborhood/community centers in growing secondary/tertiary markets.

- Ability to elevate the class level of the property through strategic improvements.

- Retail properties in primary markets can be accessed through the identification of properties with operational deficiencies, high vacancy or located in lower demographic areas.

INDUSTRIAL

- Most industrial deal profiles do not fit our criteria. We can target Class B properties in secondary/tertiary markets.

- Reaching manufacturing/warehouse industrial properties in our target markets would likely require retrofitting value-add Class B properties to meet today’s tenant demand.

- Light Industrial and Flex/R&D properties with greater percentages of office users better fit our investment criteria.

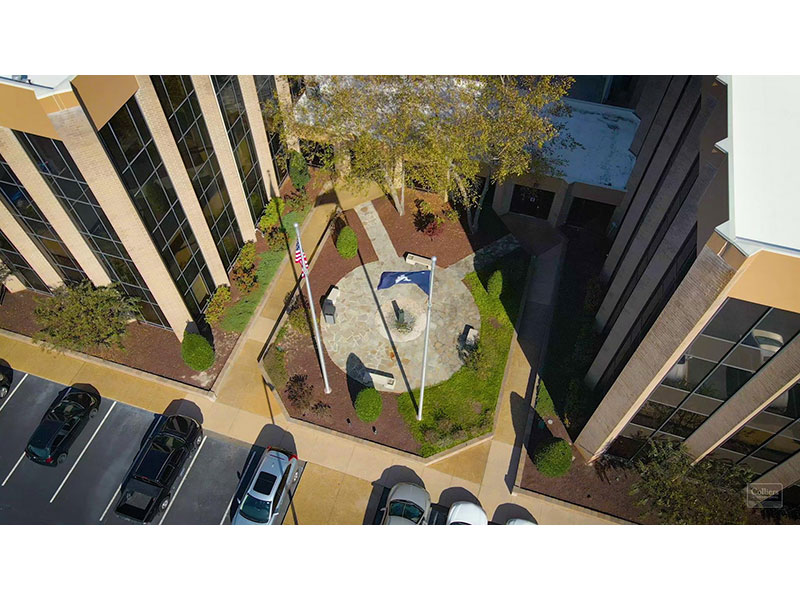

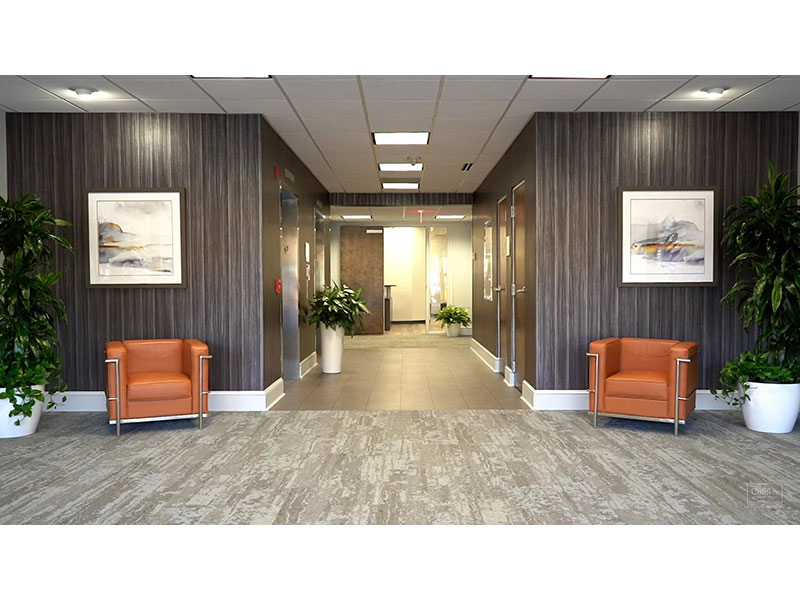

Our Portfolio

Assets Under MGMT – ETC

Prior Investments

(Partial List)

MGMT – ETC Tenants

NTF Real is lead by MGMT–ETC, a team of diverse individuals striving to deliver results that outperform expectations

With over 60 combined years of experience managing, operating and investing in commercial real estate, NTF Real has the knowledge and expertise to navigate the everchanging tides of the real estate market.