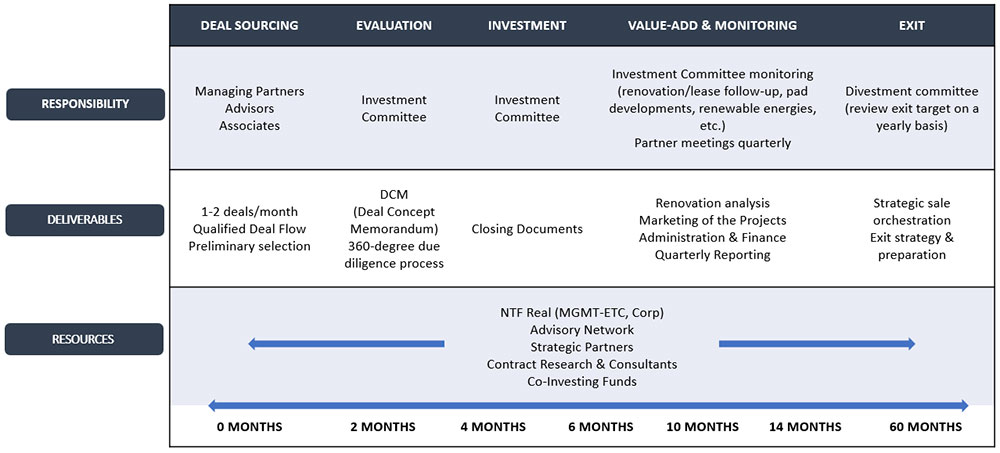

MGMT-ETC’s Process

MGMT-ETC’s Value Add Process is a strategy that involves finding commercial properties that have existing income, but may require some improvements to provide an attractive return on investment. MGMT-ETC has used this process for over 20+ years and has an extremely diverse track record of projects ranging from industrial cold storage buildings to A class office buildings.

INTRODUCTION TO CAPITAL GAINS TAX AND THE 1031 EXCHANGE

The 1031 transaction will be handled by a required and reputable 1031 intermediary in conjunction with NTF Real, attorneys, and accountants. A 1031 exchange derives from Section 1031 of the U.S Internal Revenue Code, which provides investors an avenue to defer paying capital gains taxes. Upon the sale of an investment property the investors can reinvest their proceeds from the sale, within a defined time period, into a property, or properties, of like kind and equal or greater value without the burden of a 20% capital gains tax.

NTF Real is lead by MGMT–ETC, a team of diverse individuals striving to deliver results that outperform expectations

With over 60 combined years of experience managing, operating and investing in commercial real estate, NTF Real has the knowledge and expertise to navigate the everchanging tides of the real estate market.